Financial Planning Tips for Navigating Economic Uncertainty

Navigating financial decisions during uncertain economic periods can feel stressful. Markets shift quickly, prices rise, and future conditions may seem unclear. Even so, strong financial habits can support stability and confidence. Planning does not require predicting every outcome. It simply means preparing for change with structure and intention. When you understand your goals and approach them with care, you protect your well-being even when the environment feels unpredictable. This article explores practical steps that help you stay grounded and make thoughtful choices, no matter what the economy brings.

Assessing Your Current Situation

A realistic picture of your finances sets the stage for every smart decision. Begin by reviewing your income streams, recurring expenses, and available savings. These details reveal how prepared you are to handle unexpected events. They also show where adjustments may be needed. Many people discover patterns that limit their progress without realizing it. Taking the time to examine your habits gives you clarity. That clarity allows you to ensure your actions align with your priorities. When you know exactly where you stand, planning becomes far easier and more effective.

Strengthening Your Budget

A flexible budget is one of the most important tools during uncertain times. It helps you understand where your money goes and how small changes can support bigger goals. Review your spending often. Identify areas where costs can be reduced without harming your lifestyle. Direct those savings toward essentials that matter long-term. A strong budget allows you to shift resources when conditions change. It keeps you steady and prevents overspending during stressful moments. With consistent tracking, you build a system that supports both stability and resilience.

Building A Reliable Emergency Fund

An emergency fund is a simple yet powerful financial buffer. It gives you protection when life presents sudden challenges. Whether it’s a medical expense, …

Many pet ID tags now have GPS tracking capabilities so that you can keep tabs on your

Many pet ID tags now have GPS tracking capabilities so that you can keep tabs on your

Working with influencers is not just …

Working with influencers is not just …

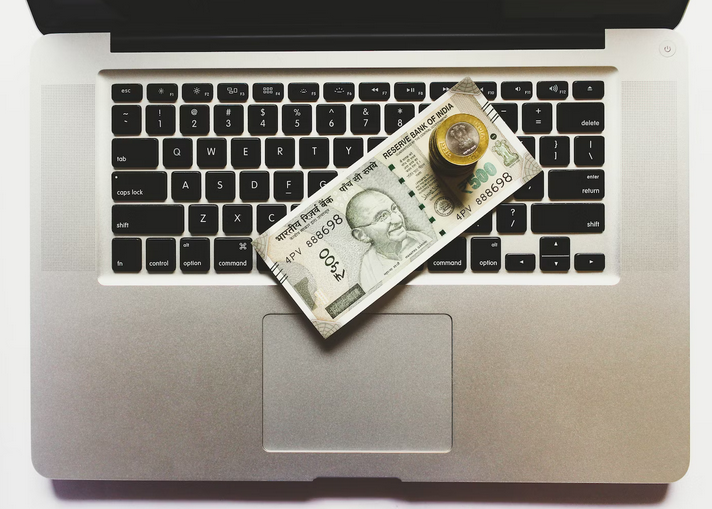

While there are many forms of loans out there, many have gone online, and installment loans are considered one, if not the, most popular method of financing a project. The installment loan is taken in one lump sum and then gradually paid back, usually in monthly payments.

While there are many forms of loans out there, many have gone online, and installment loans are considered one, if not the, most popular method of financing a project. The installment loan is taken in one lump sum and then gradually paid back, usually in monthly payments.

One of the best ways to feel confident in your clothes is to make sure you’re comfortable with what you’re wearing. Many people feel comfortable wearing t-shirts. You can learn about the companies selling best T-shirts for women by doing some research. When shopping, choose items that are comfortable and that you know you look good in. This way, you can focus on enjoying your day instead of worrying about your clothes. However, some people prefer style over comfort.

One of the best ways to feel confident in your clothes is to make sure you’re comfortable with what you’re wearing. Many people feel comfortable wearing t-shirts. You can learn about the companies selling best T-shirts for women by doing some research. When shopping, choose items that are comfortable and that you know you look good in. This way, you can focus on enjoying your day instead of worrying about your clothes. However, some people prefer style over comfort. Lastly, if you want to feel confident in your clothes, choose the right colors. Certain colors can be very flattering, while others can make you look washed out or sick. It is important to keep in mind your skin tone and hair color when choosing colors. If you are unsure about what colors look best on you, ask a friend or family member …

Lastly, if you want to feel confident in your clothes, choose the right colors. Certain colors can be very flattering, while others can make you look washed out or sick. It is important to keep in mind your skin tone and hair color when choosing colors. If you are unsure about what colors look best on you, ask a friend or family member …

Checking your credit score before applying for a loan is the first step. There are many different ways to check your credit report. You can choose between an online application and an email request. These methods include a credit report, credit score, and credit history. A credit report will give you an evaluation of where you stand with your creditors and the status of your credit accounts.

Checking your credit score before applying for a loan is the first step. There are many different ways to check your credit report. You can choose between an online application and an email request. These methods include a credit report, credit score, and credit history. A credit report will give you an evaluation of where you stand with your creditors and the status of your credit accounts.

Running for elections involves the need for money. Without the money, it is difficult to run a successful campaign. It’s not just about spending on campaigns but also for yourself and your staff. You need enough funds to cover all of these expenses and more.

Running for elections involves the need for money. Without the money, it is difficult to run a successful campaign. It’s not just about spending on campaigns but also for yourself and your staff. You need enough funds to cover all of these expenses and more.

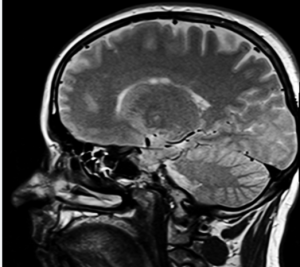

If you are constantly in a dull mood and feel stressed or anxious, handling the day-to-day tasks and even making decisions may be hard. Luckily, you can use a smart drug to boost your mood and keep you in high spirits. According to brain specialists, mood issues are connected to brain functions, and you can improve them using nootropics.

If you are constantly in a dull mood and feel stressed or anxious, handling the day-to-day tasks and even making decisions may be hard. Luckily, you can use a smart drug to boost your mood and keep you in high spirits. According to brain specialists, mood issues are connected to brain functions, and you can improve them using nootropics. Typically, memory decline comes with old age. But, no matter your age, the supplements can help to improve your memory significantly. The nootropics have been in use for many years for strengthening memory but primarily was used by the seniors who had age-associated memory problems.

Typically, memory decline comes with old age. But, no matter your age, the supplements can help to improve your memory significantly. The nootropics have been in use for many years for strengthening memory but primarily was used by the seniors who had age-associated memory problems.

One of the main reasons you should buy CBD dog products is that they have health benefits. It can be frustrating when your dog is suffering from conditions that may undermine its health. As a dog owner, it is your responsibility to ensure that your dog is always healthy, and one way of doing that is by using CBD dog products.

One of the main reasons you should buy CBD dog products is that they have health benefits. It can be frustrating when your dog is suffering from conditions that may undermine its health. As a dog owner, it is your responsibility to ensure that your dog is always healthy, and one way of doing that is by using CBD dog products. The second reason you should consider buying your dog some CBD pet products is that they are readily available. Since the legalization of cannabis in some states and countries, it is now considered easier to get CBD products. There are currently many online websites and dispensaries that are selling CBD …

The second reason you should consider buying your dog some CBD pet products is that they are readily available. Since the legalization of cannabis in some states and countries, it is now considered easier to get CBD products. There are currently many online websites and dispensaries that are selling CBD …

Many countries have legalized the selling of weed for medicinal purposes and others for recreation, and getting enough quality products for your customers will reap tremendous profits. If you sell CBD products with a high quantity of marijuana, it will get your customers high, and you may be breaking the CBD laws. The best quality CBD comes from the organic hemp plant, and it is essential to check if the product has insecticides and avoid making any purchases.

Many countries have legalized the selling of weed for medicinal purposes and others for recreation, and getting enough quality products for your customers will reap tremendous profits. If you sell CBD products with a high quantity of marijuana, it will get your customers high, and you may be breaking the CBD laws. The best quality CBD comes from the organic hemp plant, and it is essential to check if the product has insecticides and avoid making any purchases. Some wholesalers offer a wide range of CBD products and do not provide excellent deals for bulk purchases of weed. Organizations of this kind will never retain their customers and only focus on maximizing their profits. If you use this kind of company, you will incur more cost when buying your favorite strain in bulk. It is essential to check what the wholesalers claim to offer and confirm if it suits your needs and reaches your target market. Reputable CBD wholesalers offer a wide range of products at affordable prices.…

Some wholesalers offer a wide range of CBD products and do not provide excellent deals for bulk purchases of weed. Organizations of this kind will never retain their customers and only focus on maximizing their profits. If you use this kind of company, you will incur more cost when buying your favorite strain in bulk. It is essential to check what the wholesalers claim to offer and confirm if it suits your needs and reaches your target market. Reputable CBD wholesalers offer a wide range of products at affordable prices.…

3D printing allows you to manufacture more complex designs compared to the previous manufacturing processes. Previous manufacturing processes have many restrictions that do not apply to the 3D printing process. Consider a situation where you have to print a complex structure with twists or a complicated design. A 3D printer is likely to have delivered in a few hours; something previous manufacturing methods cannot accomplish.

3D printing allows you to manufacture more complex designs compared to the previous manufacturing processes. Previous manufacturing processes have many restrictions that do not apply to the 3D printing process. Consider a situation where you have to print a complex structure with twists or a complicated design. A 3D printer is likely to have delivered in a few hours; something previous manufacturing methods cannot accomplish.

With online psychic readings, you will have an opportunity to look forward to greater flexibility. When it comes to your readings, you can relax at home and get your reading done there. If you want to experience using a psychic, make sure you find reliable sources to get the best services you need.

With online psychic readings, you will have an opportunity to look forward to greater flexibility. When it comes to your readings, you can relax at home and get your reading done there. If you want to experience using a psychic, make sure you find reliable sources to get the best services you need.

An LLC is a business structure where individual owners are not accountable for the company’s debts. A closer look at the LLC model shows that they are essentially a hybrid legal entity with the characters of a sole proprietorship and a partnership. Ideally, an LLC is essentially a simplified business model designed to protect business owners’ interests.

An LLC is a business structure where individual owners are not accountable for the company’s debts. A closer look at the LLC model shows that they are essentially a hybrid legal entity with the characters of a sole proprietorship and a partnership. Ideally, an LLC is essentially a simplified business model designed to protect business owners’ interests.

The second factor that is essential in helping you make the right choice when choosing a website design company is resources. You must consider the type of resources a given company has. Companies tend to have different capabilities.

The second factor that is essential in helping you make the right choice when choosing a website design company is resources. You must consider the type of resources a given company has. Companies tend to have different capabilities.

It is also crucial to consider the reputation of a given logistics company before hiring their services. Although many logistic companies promise quick and effective deliveries, not all deliver their promises. It can be frustrating working with a logistic company that is not reliable, and this might lead to losses to an

It is also crucial to consider the reputation of a given logistics company before hiring their services. Although many logistic companies promise quick and effective deliveries, not all deliver their promises. It can be frustrating working with a logistic company that is not reliable, and this might lead to losses to an

There is no precise procedure, everyone can make their proposal, but specific criteria will have to be taken into account to give it meaning. Therefore, you can create your day and make good communication via social networks to create a buzz. On the other hand, creating an

There is no precise procedure, everyone can make their proposal, but specific criteria will have to be taken into account to give it meaning. Therefore, you can create your day and make good communication via social networks to create a buzz. On the other hand, creating an

This is a tradition that is typically practiced by every culture around the world. On the new year’s eve, you can hear sounds of fireworks filling up the night, and in some places, people gather together, lighting up even bigger fireworks as they wait to cross to the new year together. For example, many people gather at the Auckland Sky Tower in New Zealand and light up a massive fireworks display. The same happens in Australia, where they gather at the Sydney Harbor, and people also congregate in Toronto in Canada and Rio in Brazil.

This is a tradition that is typically practiced by every culture around the world. On the new year’s eve, you can hear sounds of fireworks filling up the night, and in some places, people gather together, lighting up even bigger fireworks as they wait to cross to the new year together. For example, many people gather at the Auckland Sky Tower in New Zealand and light up a massive fireworks display. The same happens in Australia, where they gather at the Sydney Harbor, and people also congregate in Toronto in Canada and Rio in Brazil.

Media organizations, including radio stations and print outfits, have established their websites to cater to their followers in and out of the country they are located in.

Media organizations, including radio stations and print outfits, have established their websites to cater to their followers in and out of the country they are located in.

widely preferred for its medical benefits. The extract is in oil form and can undergo manufacturing to come up with other related products. A lot of people have been asking what is CBD Oil good for? Well, the product can treat a wide range of conditions. Anxiety is one condition that is managed using CBD. It comes into contact with CB1 and CB2 receptors in your endocannabinoid system to leave your body feel relaxed.

widely preferred for its medical benefits. The extract is in oil form and can undergo manufacturing to come up with other related products. A lot of people have been asking what is CBD Oil good for? Well, the product can treat a wide range of conditions. Anxiety is one condition that is managed using CBD. It comes into contact with CB1 and CB2 receptors in your endocannabinoid system to leave your body feel relaxed.

Anxiety often goes undiagnosed, yet its impact can be as severe as other mental health disorders like schizophrenia, dementia, or bipolar disorder. People take the condition for granted because they mistake it for mere stress. However, anxiety can be counterproductive to a person’s life.

Anxiety often goes undiagnosed, yet its impact can be as severe as other mental health disorders like schizophrenia, dementia, or bipolar disorder. People take the condition for granted because they mistake it for mere stress. However, anxiety can be counterproductive to a person’s life. Contrary to the popular myth that claims smoking marijuana as harmful to a person’s sexual health, a 2017 study led by rs Dr. Michael L. Eisenberg and Dr. Andrew J. Sun from the Department of Urology, at Stanford University, California, concluded that cannabis use before sex could enhance the subjects’ sexual satisfaction.

Contrary to the popular myth that claims smoking marijuana as harmful to a person’s sexual health, a 2017 study led by rs Dr. Michael L. Eisenberg and Dr. Andrew J. Sun from the Department of Urology, at Stanford University, California, concluded that cannabis use before sex could enhance the subjects’ sexual satisfaction.  The popular belief of marijuana causing a person’s cognition to degrade is perhaps caused by observing marijuana users who abuse the plant. In high doses, cannabis can harm you, especially your ability to think. But

The popular belief of marijuana causing a person’s cognition to degrade is perhaps caused by observing marijuana users who abuse the plant. In high doses, cannabis can harm you, especially your ability to think. But

Helpful during Packing

Helpful during Packing

Paintball will help you to work both the body and mind. The key reason is that you will get involved in activities like running, crawling, walking, hiding and keeping alert. If you wish to get the most out of your paintball gaming sessions, you should get an excellent marker. Excellent paintball guns with the latest technology will help you to survive out on the paintballing field. The marker to purchase will depend on your level of ability and how frequent you want to play. Good paintball markers should be light for maneuverability and robust to withstand the fast-paced action.

Paintball will help you to work both the body and mind. The key reason is that you will get involved in activities like running, crawling, walking, hiding and keeping alert. If you wish to get the most out of your paintball gaming sessions, you should get an excellent marker. Excellent paintball guns with the latest technology will help you to survive out on the paintballing field. The marker to purchase will depend on your level of ability and how frequent you want to play. Good paintball markers should be light for maneuverability and robust to withstand the fast-paced action.

Graphics are a great way to change the look of your bike. It all depends on the kind of look that you …

Graphics are a great way to change the look of your bike. It all depends on the kind of look that you …

Instead of buying those cheesy cards or toys from the store, which is expensive and doesn’t scream unique at all, why not make a gift on your own? If you can draw, you can draw …

Instead of buying those cheesy cards or toys from the store, which is expensive and doesn’t scream unique at all, why not make a gift on your own? If you can draw, you can draw …

Before you start cleaning the surfaces, it is important to gain an understanding of the grain’s direction. The surfaces of stainless steel, just like wood, have grains in the same direction. The handles and knobs have grain which may be in a different direction. When you clean against the grain, you will be pushing more residue into crevices that are part of the grain. When cleaning is done along the grain, your surface will shine optimally.

Before you start cleaning the surfaces, it is important to gain an understanding of the grain’s direction. The surfaces of stainless steel, just like wood, have grains in the same direction. The handles and knobs have grain which may be in a different direction. When you clean against the grain, you will be pushing more residue into crevices that are part of the grain. When cleaning is done along the grain, your surface will shine optimally.

In case you do not know, there is no cheat in losing weight. You have to get out there and hit the gym. Relying solely on pills will only ruin your metabolic …

In case you do not know, there is no cheat in losing weight. You have to get out there and hit the gym. Relying solely on pills will only ruin your metabolic …

Before you even go out there in search of an interior designer, you should be sure of what you need. You need to have a clear picture of the type of the interiors that you need. This might require you to do a lot of research and comparisons. Spare some time to explore the internet and get to know some of the designs that are available. You can also walk into your friend’s houses and see what kind of designs that they have adopted. This way it will be easy for you to find a designer who will satisfy your needs.

Before you even go out there in search of an interior designer, you should be sure of what you need. You need to have a clear picture of the type of the interiors that you need. This might require you to do a lot of research and comparisons. Spare some time to explore the internet and get to know some of the designs that are available. You can also walk into your friend’s houses and see what kind of designs that they have adopted. This way it will be easy for you to find a designer who will satisfy your needs.